multistate tax commission member states

The Multistate Tax Commission is a United States intergovernmental state tax agency created by the Multistate Tax Compact in 1967. The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several.

1 It is the executive agency charged with administering the Multistate Tax Compact.

. The Multistate Tax Commission MTC adopted its long-awaited guidance interpreting Public Law PL 86-272 protections for internet businesses on August 4 2021. A group appointed by the member states that writes rules and regulations interpreting the Uniform Division of Income for Tax Purposes Act. The associate member states are Arizona Connecticut Florida Illinois Indiana Iowa Maine Massachusetts Mississippi Nebraska New Hampshire New York North Carolina Ohio.

Contact us multistate tax commission 444 north capitol street. The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws. The Multistate Tax Commission not more than once in five years may adjust the 100000 figure in order to reflect such changes as may.

S are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the Commission. Sovereignty members are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the. It also created what is known as the national.

Multistate Tax Commission - Home An intergovernmental state tax agency whose mission is to promote uniform and consistent tax policy and administration among the states assist. The compact is intended to help states administer tax laws that apply to multistate. The Multistate Tax Compact is an interstate compact among 15 states and the District of Columbia.

The Multistate Tax Commission MTC is an interstate instrumentality located in the United States. Examples of Multistate Tax Commission in a sentence. 2 as of 2021 the district of columbia and all 50 states except for nevada are members in some capacity.

MULTISTATE TAX COMMN1978 No. Multistate Tax Commission means. This system supports remote sellers and advocates that they collect and remit sales tax to member states when required by law.

The Multistate Tax Compact was. Multistate Tax Commission - Resources Uniform Sales Use Tax Resale Certificate - Multijurisdiction This multijurisdiction form has been updated as of June 21 2022. FAMILY OWNED FOUNDED IN 2010 OVER 50 YEARS OF EXPERIENCE FRIENDLY AFFORDABLE OPEN ALL YEAR LONG MEMBERS OF BBB NATP REMINDER LIST FOR YOUR TAX RETURN.

United States Supreme Court. As of 2011 47 states are members of the Commission in. October 11 1977 Decided.

The associate member states are Arizona Connecticut Florida Illinois Indiana Iowa Maine Massachusetts Mississippi Nebraska New Hampshire New York North Carolina Ohio.

Income Tax Nexus And Public Law Or When Will Your Activities In Another State Subject You To Income Taxation In That State Pdf Free Download

Cost Council On State Taxation

Recent California State And Local Tax Developments The Cpa Journal

Multistate Tax Commission S View Of P L 86 272 Is Changing

Implementing Recent Mtc Guidelines Pl 86 272 And The Finnigan Method Cpe Taxops

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Ussfcu The Hall Of The States Ussfcu Washington D C Alexandria Va Bethesda Md

Multistate Tax Commission Home

Multistate Tax Commission Home

Multistate Tax Commission Home

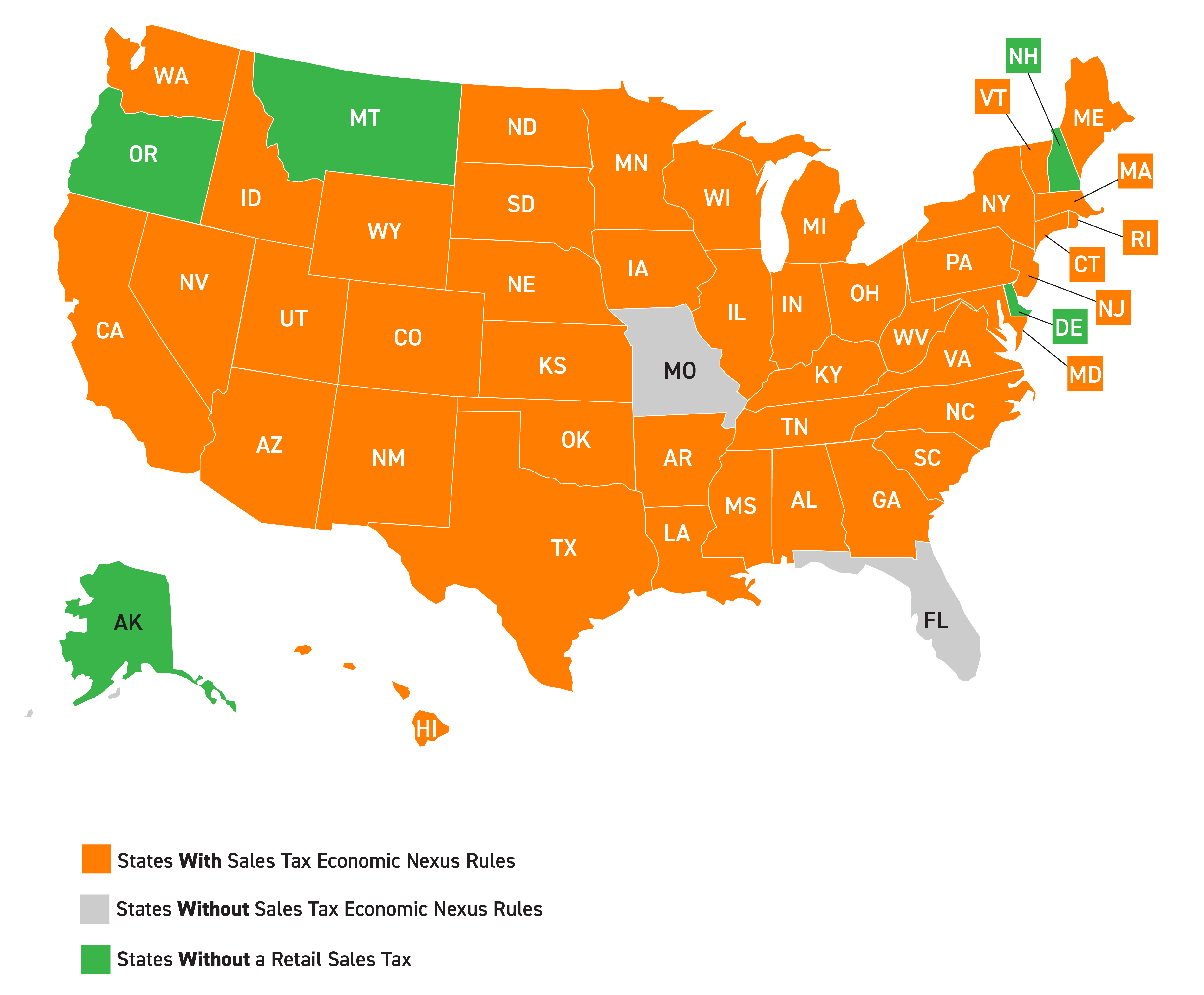

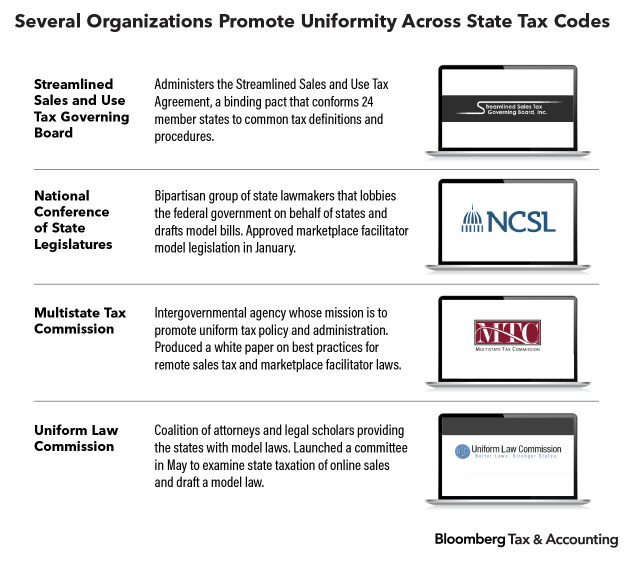

Online Sellers Lament Lack Of State Sales Tax Uniformity

Multistate Tax Commission Home

Multistate Tax Commission Home

Forty Two States Have Now Adopted Marketplace Sales Tax Collection Laws Multistate

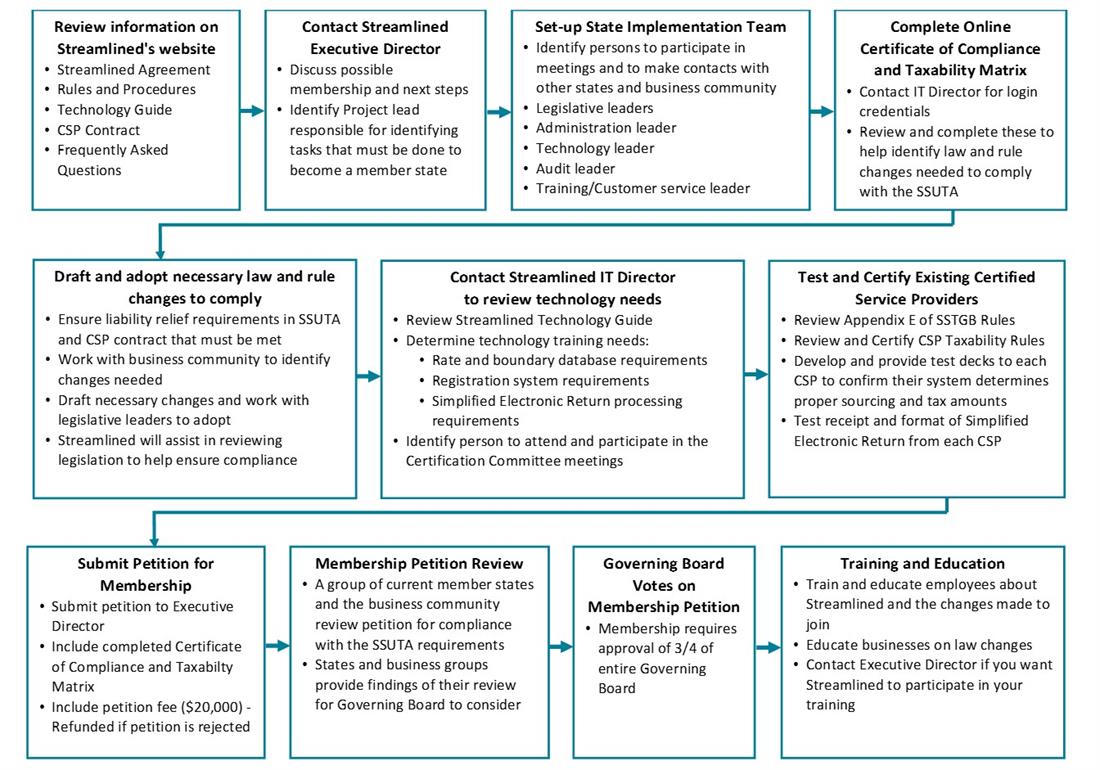

State Membership Process Chart

Why States Need To Enact Mtc Model Statute In 2020 Journal Of Accountancy

Multistate Tax Commission Home